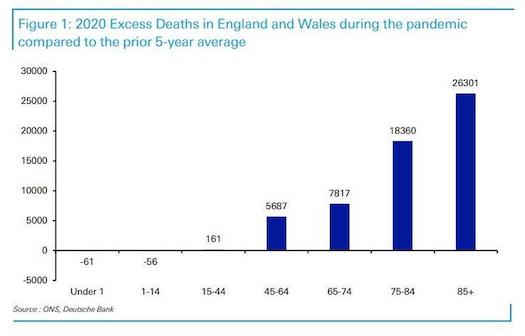

While we have previously reported – and by now it is common knowledge – that Covid-19 usually kills only the very old with virtually no deaths in the 45 and under category and most deaths in the 75 and over category.

While we have previously reported – and by now it is common knowledge – that Covid-19 usually kills only the very old with virtually no deaths in the 45 and under category and most deaths in the 75 and over category.

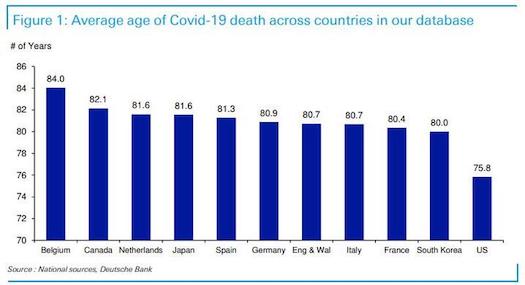

Indeed, as Deutsche Bank’s Jim Reid noted when discussing the average age of fatalities from Covid, “it is remarkably consistent around the 80-82 year old mark.”

Then overnight, Bloomberg’s John Authers pointed out how startling this mortality rate varies from country to country, when referencing another chart from Jim Reid:

Then overnight, Bloomberg’s John Authers pointed out how startling this mortality rate varies from country to country, when referencing another chart from Jim Reid:

As Authers writes, “The U.S. is a remarkable outlier. How can that possibly be?”

As Authers writes, “The U.S. is a remarkable outlier. How can that possibly be?”

According to Reid, a small part of this might be down to many of the other countries having an older population. For example, Italy’s median age is 45 (43 in Europe), whereas it is 38 for the US.

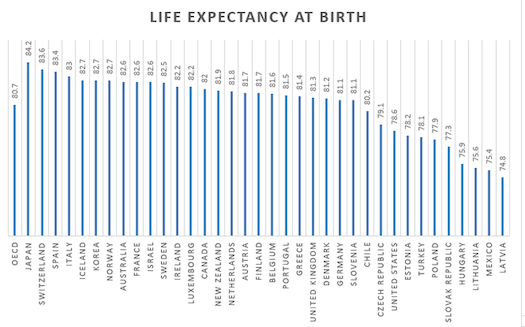

However, another explanation offered by the Bloomberg commentator, which feeds into the political debate of the moment, “is that all the other developed countries on this chart have some form of universal state-provided healthcare.” But rather than get embroiled in that debate, Authers instead looks at the normal average age of people when they die. The following is a chart of life expectancy (in years) at birth for all the members of the Organization for Economic Cooperation and Development:

As shown in the chart above, the U.S. – which as we discussed last week is turning into a banana republic with just a 50% share of the population in middle-income households, roughly the same category as Turkey, China and, drumroll, Russia – has lower life expectancy than the Czech Republic or Chile, and is lagged only by countries that are significantly poorer. It trails the other major economies by several years, in many cases roughly equal to the gap in the age at which Covid-19 victims die.

As shown in the chart above, the U.S. – which as we discussed last week is turning into a banana republic with just a 50% share of the population in middle-income households, roughly the same category as Turkey, China and, drumroll, Russia – has lower life expectancy than the Czech Republic or Chile, and is lagged only by countries that are significantly poorer. It trails the other major economies by several years, in many cases roughly equal to the gap in the age at which Covid-19 victims die.

According to Authers, instead of focusing on Covid, “it might make sense for the U.S. healthcare debate to revolve around treating this as a national disgrace and trying to make common cause over fixing it, rather than having an arid political argument, but I digress.”

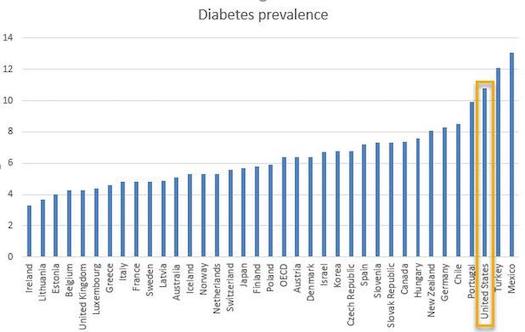

Which brings us to the topic at hand, namely does America have a covid problem, or is it just an extension of America’s far more serious problem of obesity. To wit, tne of its greatest life-shortening effects is diabetes. Here are the most recent OECD numbers on diabetes prevalence:

As Authers observes, “the U.S. lags behind only the much poorer nations of Turkey and Mexico in this dismal category, and has more than double the diabetes prevalence of the main developed economies of Europe”, and summarizes:

As Authers observes, “the U.S. lags behind only the much poorer nations of Turkey and Mexico in this dismal category, and has more than double the diabetes prevalence of the main developed economies of Europe”, and summarizes:

Once the country has finished tearing itself apart over the pandemic, which will probably only happen once the virus has finally gone away, a new debate over diabetes and obesity will be necessary. Let’s hope it can be more constructive than the current one.

The numbers also shed light on why the US has had a relatively difficult time containing the pandemic according to the Bloomberg author, and also suggests that a “Swedish” model of “focused protection” for those most vulnerable could be harder to apply to the US, because a far higher proportion of obese Americans are at risk. In other words,”allowing most of the population to return to life as normal is going to require confining a lot of people to their homes for the duration — judging by the diabetes numbers, maybe twice as many as in Sweden, as a proportion of the population. As Authers puts it “that isn’t feasible.”

Of course, concerns about the obesity epidemic – and not just in the U.S. – are nothing new, and we have covered them for much of the past decade. Additionally, the attempt by investors to profit from obesity is also not new. Back in 2012, Bank of America published a report on “Globesity” which it described as one of three global mega-trends. As Authers reminds us, “it offered a list of 50 stocks that it thought would benefit from a global fight on obesity, including some counterintuitive names such as Pepsico Inc. and Nestle SA, both of which it thought were better positioned to move toward less fattening products — but which produce plenty of products, such as sugary drinks, that contribute to obesity.”

One year earlier, Solactive started an obesity index of smaller companies working in drugs and diagnostics connected to the issue — primarily diabetes. Soon after, Janus Henderson launched an exchange-traded fund to track it, with the appropriate ticker symbol “SLIM.” Then, in January of this year, the announcement was made that the ETF would be liquidated, an event that finally took place on March 12. As Authers writes, “that represented a missed opportunity” because this is how the obesity index has performed relative to the S&P 500 since inception.

And here a remarkable statistic: the SLIMmers have done even better than the FANGs since the market bottom, meaning that bets on America getting fatter are even more profitable than betting on the giga-caps.

And here a remarkable statistic: the SLIMmers have done even better than the FANGs since the market bottom, meaning that bets on America getting fatter are even more profitable than betting on the giga-caps.

That said, as Authers notes judging by the valuations of the obesity index at present, the short-term opportunity may have passed. It trades at an insane P/E ratio of 94.66x, (which “drops” to 30.4 if one excludes the non-profitable companies). For the longer term, however, the lesson according to Authers that all countries should learn from the dreadful experience of the U.S. over the last eight months is that any given health emergency grows that much worse if you are overweight.

In summary, “it’s too late to help in the battle against Covid-19, and it’s too late to profit from the smallest companies working in the fight against diabetes, but the world will have to combat obesity. In due course, capital will flow toward financing that fight.”

Written by Tyler Durden for Zero Hedge, October 20, 2020